Developing an Islamic PPP Financing Model using Musharakah and Istisna for Geothermal Projects in Djibouti: A Contribution toward Achieving SDG 7

Keywords:

Islamic PPP, Musharakah, Istisna, geothermal energy, stakeholders, SDG 7Abstract

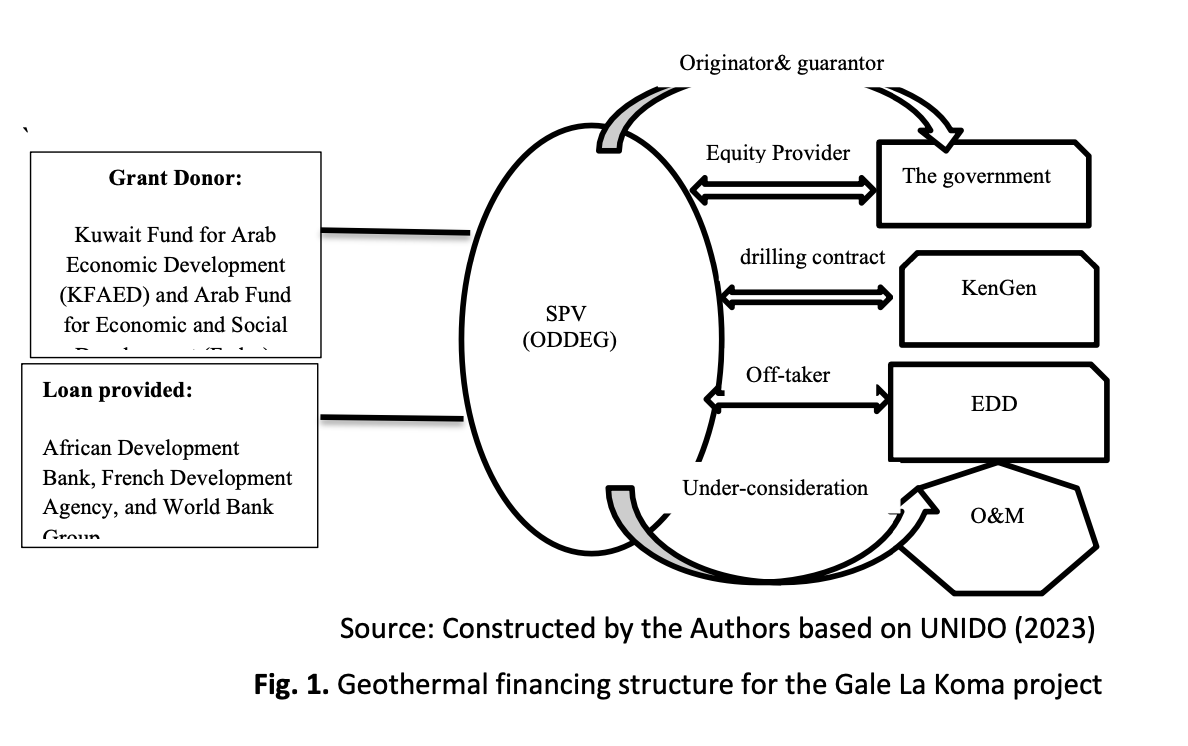

This study examines the feasibility of implementing an Islamic Public-Private Partnership (PPP) model based on Musharakah (joint venture partnership) and Istisna (construction financing) for Djibouti’s Gale La Koma geothermal project, contributing to Sustainable Development Goal (SDG) 7, which aims for affordable and clean energy. The theoretical underpinnings of this study are Islamic finance principles and the literature on public-private partnerships (PPPs), with a focus on ethical investment, risk-sharing, and sustainable infrastructure development. The research implemented a qualitative approach, conducting semi-structured interviews and surveys with key stakeholders, including government agencies, project developers, Islamic financial institutions, and local communities. The findings of this study revealed that the proposed Islamic PPP model can enhance project financing by promoting risk-sharing and adherence to Shariah principles. Nevertheless, challenges such as regulatory alignment, financial sustainability, and integration of Islamic and conventional financing need to be addressed. The study contributes to the growing discourse on integrating Islamic finance into renewable energy projects, providing a framework for expanding geothermal energy development in Djibouti and similar contexts. The added value of this study lies in developing a novel Islamic PPP model tailored to geothermal projects, demonstrating how Islamic finance can support SDG 7 while addressing stakeholder concerns in sustainable energy infrastructure.