Financial Justice and Sustainable Development: Reviving Maqasid Al-Shariah for a Changing World

Keywords:

Financial justice, sustainable development, Maqasid al-shariah, Islamic social financeAbstract

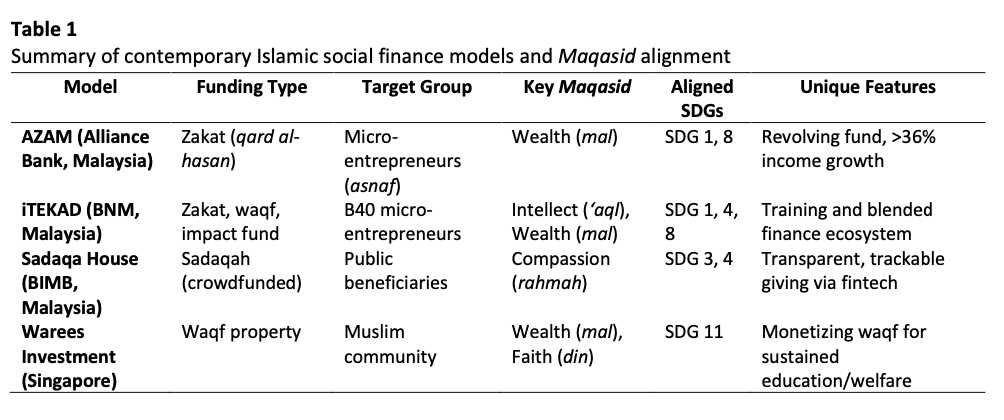

Financial justice and sustainable development are critical pillars in addressing contemporary economic disparities, particularly within the framework of Islamic economics. The increasing global inequalities, environmental degradation, and the economic recovery following the pandemic have heightened demands for a financial system that is more ethically grounded and sustainable. Although the United Nations’ Sustainable Development Goals (SDGs) have achieved global recognition, the prevailing financial architecture continues to emphasize profit at the expense of justice and inclusion. This article identifies a gap in current discourse by proposing maqasid al-shariah, the higher objectives of Islamic law, as a comprehensive ethical framework that can promote financial justice and sustainable development over the long term. The primary issue is the insufficient application of Islamic economic principles in the formulation of global financial policies, even though these principles inherently align with SDGs related to equity, inclusion, and human dignity. By applying qualitative methodology through critical literature synthesis, this study aims to investigate the revival and operationalization of maqasid al-shariah to reposition Islamic finance as a transformative instrument for achieving financial justice and sustainable development. The findings offer important insights into the relationships among Islamic social finance, maqasid al-shariah, and the SDGs. Selected case studies are analyzed to illustrate practical models of convergence between Islamic principles and sustainability objectives. The findings demonstrate a significant theoretical and practical alignment between maqasid al-shariah and the SDGs. Instruments of Islamic social finance, such as zakat, waqf, and qard al-hasan, facilitate poverty alleviation and financial inclusion while integrating ethical considerations and communal well-being into financial transactions. Challenges including institutional fragmentation, governance limitations, and insufficient impact measurement persist in hindering progress. The study concludes that reviving maqasid al-shariah is essential for embedding justice, accountability, and long-term value creation in economic systems, rather than being solely a theological exercise. Policymakers, Islamic finance institutions, and international development agencies should work together to establish maqasid as an operational framework that is grounded in values while also addressing contemporary global challenges.