Islamic Fintech and Digital Transformation: Opportunities and Shariah Governance Challenges

Keywords:

Islamic fintech, digital transformation, Shariah governance, financial inclusion, Maqasid al-Shariah, Islamic financeAbstract

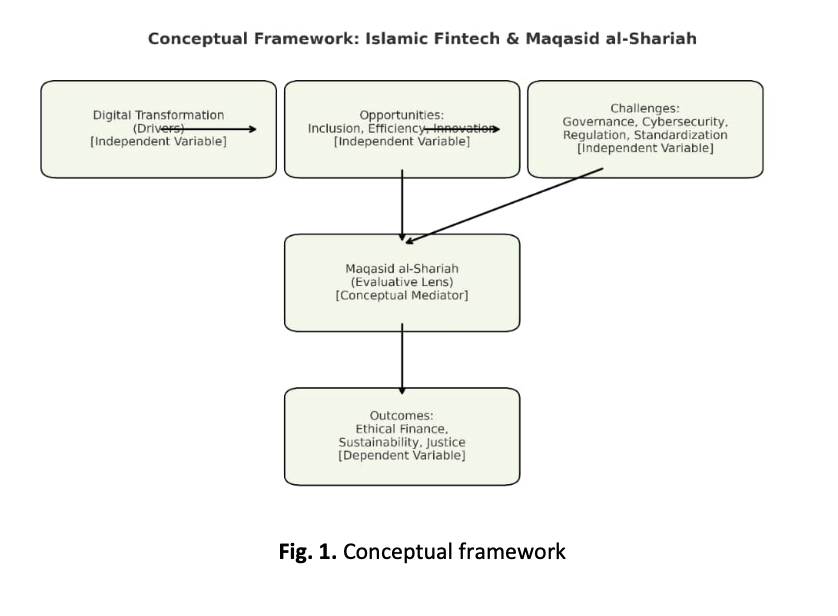

The accelerating momentum of financial technology (fintech) has reshaped global financial services by enabling efficiency, innovation, and wider access to financial products. Within this global context, Islamic fintech has emerged as a transformative force, integrating digital solutions such as blockchain-based sukuk, digital Islamic banking, crowdfunding, peer-to-peer (P2P) lending, and zakat payment platforms. These innovations aim to expand financial inclusion while remaining compliant with Shariah principles and ethical finance.Despite its potential, Islamic fintech faces significant challenges, particularly fragmented Shariah governance, lack of regulatory harmonization across jurisdictions, and rising cybersecurity threats. These issues threaten the sustainability, credibility, and global scalability of Islamic fintech if not adequately addressed. Furthermore, the absence of a unified framework that systematically integrates technological opportunities with ethical and Shariah imperatives highlights a critical gap in both research and practice.

The purpose of this study is to analyze the dual dimensions of Islamic fintech by exploring its opportunities for financial inclusion, efficiency, and innovation, while also critically examining its governance challenges. The study further seeks to embed these discussions within the framework of Maqasid al-Shariah to ensure that digital transformation in Islamic finance advances justice, inclusivity, and socio-economic sustainability.

A conceptual and qualitative methodology is employed, relying on extensive literature review, secondary data synthesis, and analysis of regulatory frameworks and Shariah governance principles. This approach allows for the integration of perspectives from finance, law, and Islamic ethics, producing a multidisciplinary conceptual model.The findings reveal that while Islamic fintech demonstrates strong potential for inclusion and innovation, its sustainability depends on the development of robust Shariah governance structures, greater global regulatory harmonization, enhanced cybersecurity safeguards, and systematic application of Maqasid al-Shariah in product development and oversight.The paper concludes by proposing a conceptual model for aligning digital transformation with Islamic ethical objectives and offering policy recommendations to regulators, practitioners, and policymakers. These include strengthening Shariah auditing mechanisms, promoting cross-border standardization, and embedding ethical accountability into digital financial ecosystems. The study highlights the importance of balancing innovation with governance to ensure that Islamic fintech evolves as both technologically effective and ethically grounded.