Strategic Role of Foreign Direct Investment in Driving National ESG Implementation: Innovative Pathways for Sustainable Economic Transformation

DOI:

https://doi.org/10.37934/arbms.40.1.6571Keywords:

Foreign Direct Investment (FDI), ESG implementation, conceptual frameworkAbstract

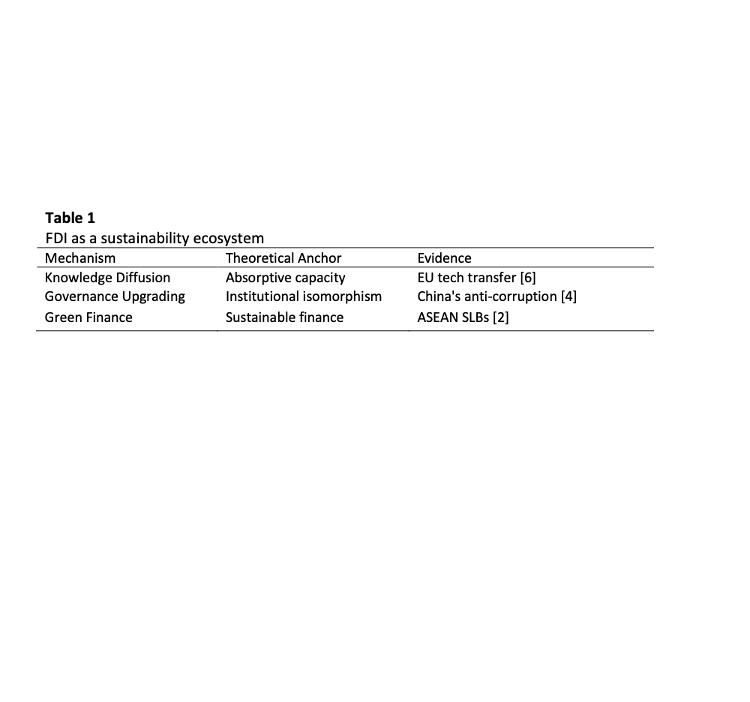

Foreign Direct Investment (FDI) has long been recognized as a driver of economic growth; however, its role in advancing national Environmental, Social, and Governance (ESG) agendas remains ambiguous. While many countries now integrate sustainability goals into their investment strategies, a clear conceptual understanding of how FDI can support systemic ESG transformation is lacking. Existing studies tend to isolate the economic, environmental, or social effects of FDI, overlook institutional dynamics, or rely on static models, leading to fragmented insights. This conceptual research addresses these gaps by exploring how FDI can be strategically governed to function as a catalyst for national ESG implementation. The purpose of this study is to develop a structured, multi-scalar analytical framework that explains the dynamic interactions between FDI and ESG outcomes across firm-level practices, national policy instruments, and transnational governance mechanisms. Drawing on institutional theory, innovation systems theory, and global value chain governance, the study constructs a conceptual model that identifies four key transformation mechanisms: knowledge spillovers, regulatory convergence, green finance signaling, and policy diffusion. These mechanisms are contextualized through comparative illustrations from the European Union, China, and ASEAN. The study finds that FDI’s ESG impact is mediated by host-country absorptive capacity, regulatory alignment, and institutional maturity, and that its transformative potential depends on coordinated governance across multiple levels. The model provides a diagnostic tool for understanding how FDI can transition from a transactional input to a strategic lever for sustainability. In conclusion, this paper contributes to both theory and practice by offering an integrative framework to align FDI governance with ESG objectives. It lays the groundwork for future empirical validation and supports policymakers in designing investment strategies that foster inclusive, resilient, and sustainable development.