The Short-Run and Long-Run Effects of Covid-19 and Macroeconomic Factors on Stock Market Performance In Malaysia

DOI:

https://doi.org/10.37934/arbms.40.1.136149Keywords:

Stock market performance, Covid-19, macroeconomic factorsAbstract

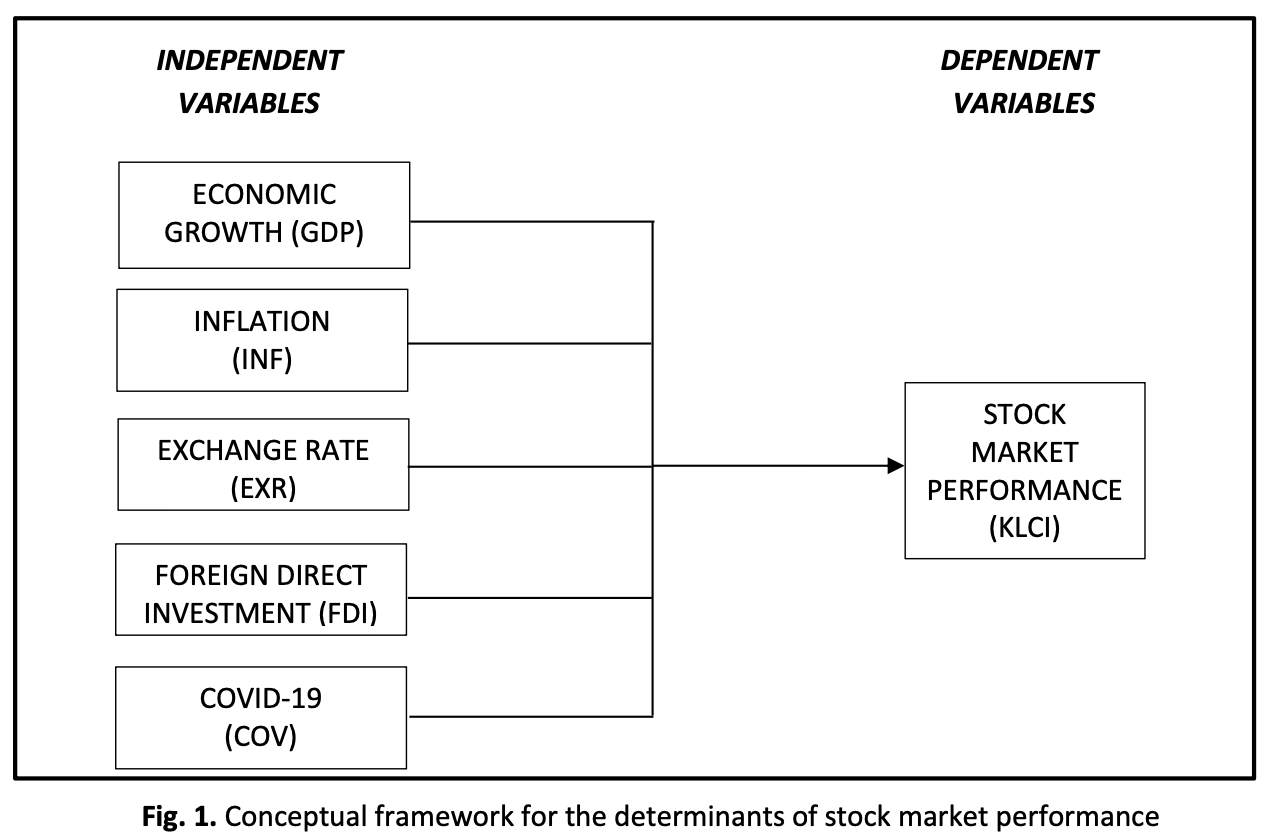

Stock market performance is commonly viewed as an indicator of the economic health, reflecting on investor confidence and the economic stability. The stock market is influenced by various domestic and international factors. In particular, the recent Covid-19 pandemic has severely weakened the stock market performance, specifically in Malaysia. Thus, the objective of this study is to evaluate the impact of Covid-19 and macroeconomics factors (economic growth, interest rate, FDI, exchange rate and inflation) on the Malaysian stock market performance between 2013 and 2023. The ARDL tests reveal that inflation continues to have a significant and positive relationship with KLCI in both short run and long run. In contrast, economic growth and Covid-19 pandemic reveal a significant and negative relationship in both periods. This study contributes to the existing literature by examining the long-term post recovery effect of Covid-19 on the Malaysian stock market performance. Thus, the results of this study could assist the policy makers in designing and strengthening the policies related to the Malaysian stock market for the benefits of the country.