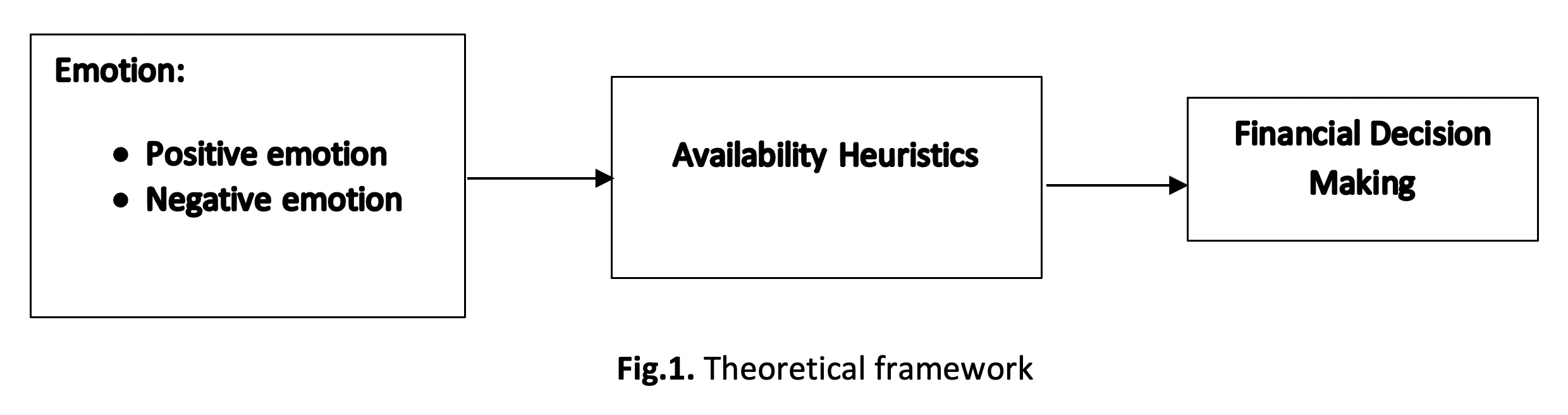

Emotions and Financial Decision-Making: A Mediating Effect of Availability Heuristic

Keywords:

Availability heuristic, emotions, financial decision-making, behavioural finance, mediation effectAbstract

Financial decision-making is strongly shaped by both emotions and cognitive shortcuts, which often lead to systematic biases. One important shortcut is the availability heuristic, where individuals judge risks and probabilities based on information that is most easily recalled. While prior studies have examined the direct influence of emotions or heuristics on financial behavior, limited research has investigated the mediating role of the availability heuristic in linking emotional states to financial decision outcomes. This study addresses that gap by exploring how positive and negative emotions influence financial risk perception and investment choices indirectly through heuristic processing. Drawing on dual-process theories, it is proposed that emotions heighten the salience of certain memories, thereby increasing reliance on easily accessible information. Survey data from retail investors, analyzed using structural equation modeling, reveal that the availability heuristic significantly mediates the relationship between emotions and financial decision making. Specifically, fear and anxiety amplify risk-averse choices through recall of negative market events, whereas optimism fosters greater risk-taking via vivid recall of success stories. These findings enrich the behavioral finance literature by identifying cognitive heuristics as a psychological mechanism through which emotions shape financial behavior. The study contributes to investor education, financial advisory practices, and policy design by suggesting strategies to mitigate bias and promote more rational decision making.