Predicting Customer Behaviour on Buying Life Insurance using Machine Learning

Keywords:

Decision trees, logistics regression, Naïve Bayes, machine learning algorithms, life insurance, predictionAbstract

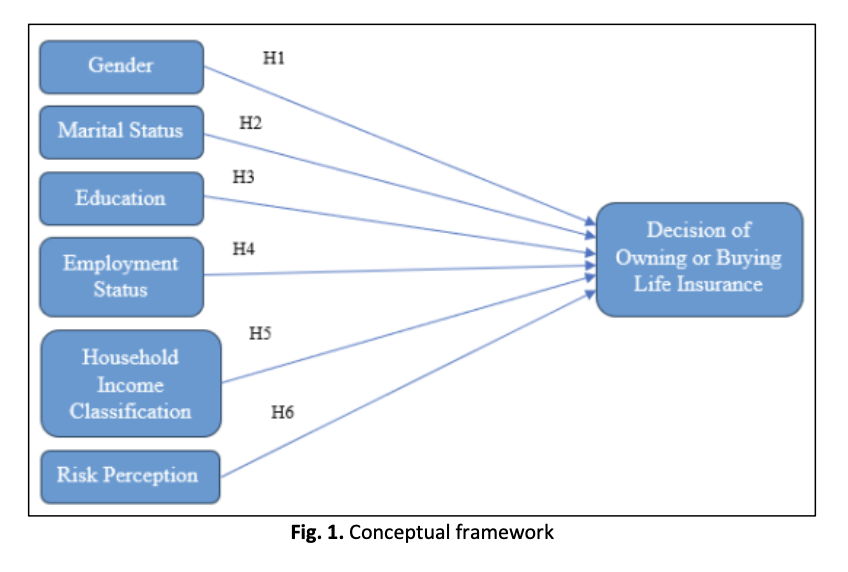

Despite modest growth in insurance penetration, Malaysia remains below the benchmark set by Bank Negara Malaysia, with life insurance still underutilized as a personal risk management tool. There are many factors that contribute to these issues. To address this, the present study investigates the potential of machine learning (ML) algorithms to predict consumer behavior in purchasing life insurance in Malaysia. The research identifies demographic factors, household income classifications, and risk perception as key determinants influencing insurance purchase decisions. Data were collected from 400 respondents through online surveys, and ML models, including logistic regression, Naïve Bayes, and decision trees, were employed for analysis. The findings reveal that gender, income group (T20), and risk perception significantly impact the likelihood of purchasing life insurance. Logistic regression emerged as the most effective algorithm, achieving an accuracy of 96.25%, followed by Naïve Bayes (93.75%) and decision trees (92.50%). These results underscore the utility of ML in analysing complex datasets and providing precise predictions, outperforming traditional methods. Future studies are recommended to utilize larger datasets to further refine predictive capabilities and explore additional influencing factors. The integration of ML models offers a promising pathway to improve insurance penetration and strengthen financial security in Malaysia.